Looking for an honest Savology review?

With the abundance of personal finance tools and money-saving apps available, it’s tough to know which one(s) you can not only trust but should at least try for yourself.

Fortunately, when we come across a new tool or app that we find useful, we’ll do our best to dive into the details and give you a thorough review so that you can make the best-informed decision you possibly can.

It’s also an opportunity for us to nerd out on a little bit.

Recently, we came across Savology, a new personal finance application that has been getting a lot of well-deserved attention lately.

In this review, we’ll breakdown Savology’s free financial planning platform, the features and offering, pros and cons, and more.

An introduction to Savology

First, let’s start with more of a proper introduction to Savology and the platform.

Savology is a fintech startup based out of Utah, that has created a financial planning platform similar to Personal Capital for everyday households looking to make significant improvements to their financial lives.

In as little as five minutes, Savology’s platform provides access to free financial planning. After successfully signing up and creating a free account, you’ll also receive personalized recommendation (known as action items), to help with those next steps, and a financial report card, which grades your finances across 12+ categories to give you a current snapshot of your financial well-being.

In addition, you’ll also have access to planning modules and activities, which are interactive literacy components used as a way to help you improve your overall financial knowledge and be more money savvy.

Savology’s mission is simple: to help households improve their financial well-being.

After having a few conversations with their team, it’s easy to tell that they are focused on helping households make those improvements. Their actions speak for themselves.

Candidly, when I first came across Savology I was a little skeptical. But after those few conversations and taking the time to go through their platform, I’m a big fan and especially of the product progress they’ve been making.

Who exactly is Savology for?

At the end of the day, every one of us remains responsible for our financial lives, no one else.

For that reason alone, it’s easy to say that Savology’s financial planning platform is made for just about anyone. As the CEO of your money, it’s critical to find and have access to a tool like Savology that can really help you double down on reinforcing good financial habits, get rid of the bad ones, and keep you focused on making steady improvements to reach your goals.

While financial planning is for everyone, there are some notable cases where it becomes even more important. These are usually associated with major life stages/events where managing our money seemingly becomes more and more of a priority.

Some of those situations include, but are not limited to the following:

- If you are recently married or are just starting a family

- If you are a recent grad who or just landed a new job

- If you are mid-way in your working career and closing in on retirement

How to create your free account and start using Savology

One of the things I’ve appreciated most about Savology is how easy it is to get started and create your free account.

The first step in building your free financial plan is to head to Savology’s website. Once you’ve arrived there, you’ll want to click on any of the ‘Get started’ buttons that will take you into the financial survey, which is also the account creation process.

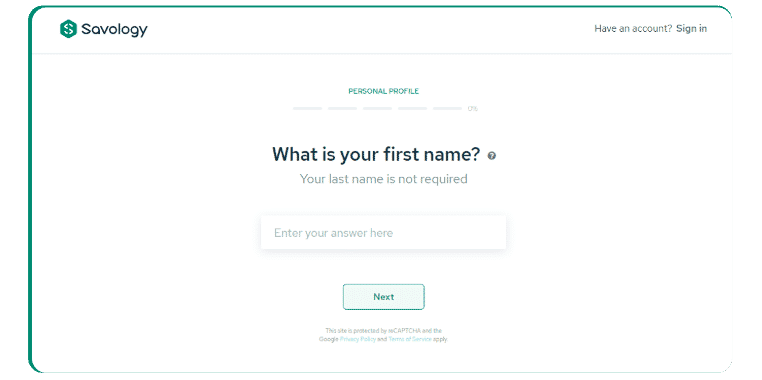

You’ll know you’re in the right place when you’ve landed on a page that looks like this:

The total survey consists of around 20-30 questions depending on your answers and your current financial situation. The questions are a combination of personal questions (name, age, location, etc), and financial questions related to your current savings, debt, retirement plans, and how you’re managing your financial risks. All of which are used to create your personal account and your financial plan.

When going through the account creation process and the survey, it’s important to keep in mind that this information is used for various financial calculations and to make personalized recommendations. The more honest you are, the more accurate your plan and recommendations will be.

As you go through the survey, you’ll notice it is broken down into five main sections:

1) Personal profile

This includes your name, age, gender, location (via zip code), and whether or not you are married or have any dependents.

2) Savings and income

This includes your estimated annual income (gross income), your current savings habits, the types of retirement and non-retirement investment accounts you currently have, along with their balances.

3) Assets and liabilities

This includes the types of assets you own along with the estimated value of each asset, the types of debts and liabilities you have in your name, the amount of total debt, whether you own your home or rent, and your credit card usage habits.

4) Risk management

This includes your estate plan details, your life insurance needs and coverage, along with other types of insurance that you might have.

5) Retirement outlook and financial goals

The last section is dedicated to your desired financial outcome. You’ll be asked the age at which you want to retire, the type of lifestyle you wish to live throughout your retirement years, and the state of your current health.

Product Features & Offering

When you create your free Savology account, you’ll immediately get access to a lot of really beneficial and useful features. Each of the features offered by Savology are used to compliment your financial plan and are used as different ways to help you better understand your finances and make significant improvements.

Here’s what you’ll get for free:

1) A financial plan

First and foremost, after creating your free account you’ll get access to a financial plan that you can use to guide your future financial decisions. Your Savology plan is broken down into 4 major areas: Savings and income; Assets and liabilities; Risk management; and your retirement outlook.

One of the best things about your plan is that it provides both a high level overview of the four sections, along with detailed explanations and breakdowns about each sub-section.

My favorite part about Savology’s entire platform, has to be the different types of calculations your plan makes.

Here’s a list of a few important calculations your plan will make that you have access to:

- Your savings rate

- Your emergency fund needs

- Your life insurance needs (showing a gap or surplus)

- Your other insurance needs

- Your calculated net worth

- Your debt-to-income ratio

- Your project retirement age and income

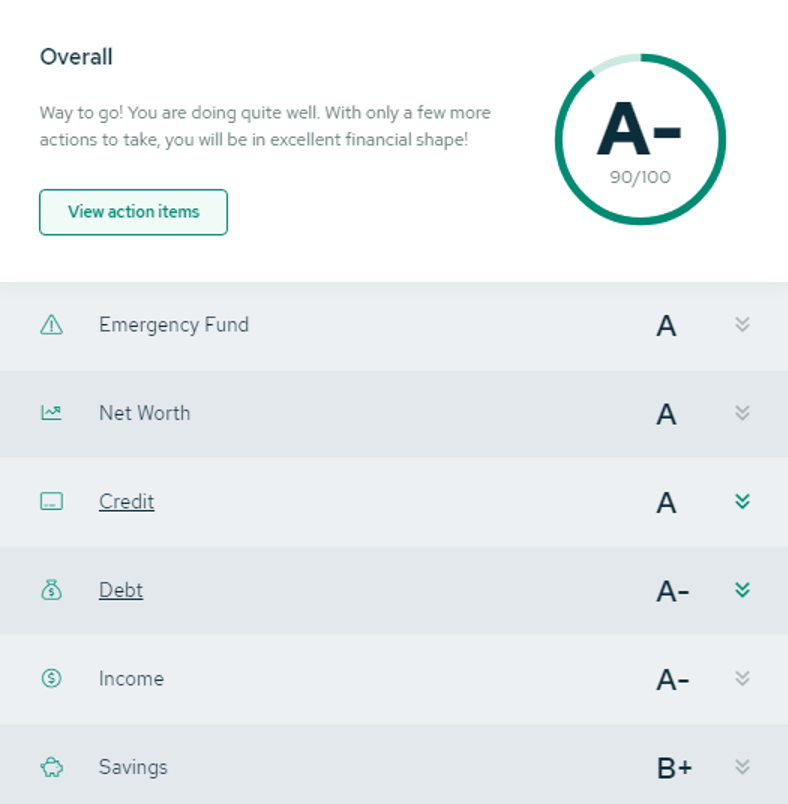

2) Financial report card

Your financial report is exactly what it sounds like— a report card that grades your finances. More specifically, your report card essentially takes a snapshot of your current financial picture providing you with grades across 12+ different financial categories as a way of showing you the areas that you’re doing well in, and where you need to pay more attention.

These categories include: Credit, debt, income, housing, savings, retirement, emergency fund, insurance, and more.

In addition to the letter grade you’ll receive for each category, your report card also provides a description about why you’ve received that particular grade, along with ways to improve it.

3) Recommended action items

When you build your plan, you’ll also receive action items. These are your recommended next steps based on your financial goals (your retirement outlook) and the areas that you need to start improving right away.

You can think of action items as larger, bigger steps you need to take to make significant improvements.

Each action item that your plan provides will come with details about why the action item is recommended, how it benefits your plan, and what you need to do to complete it.

4) Planning modules and activities

Planning modules exist to help you enrich and improve your financial literacy. Whereas activities are smaller tasks provided by your plan that will help you make tiny incremental improvements to your overall literacy.

Together, these two provide more interactive ways to continue working on your finances.

After going through each of the modules and a few of the activities myself, I’d highly recommend taking the financial literacy quiz (module) and using the budgeting tool module. I found both of these pretty fun to do and informative at the same time.

While there are quite a few modules available, the only downside is that there are still quite a few modules unavailable in the platform yet.

5) Savology Stars

Savology Stars is where a little bit of gamification makes its way into the platform. You can earn stars through a variety of different ways such as sharing the platform with your friends, completing action items, completing modules, completing activities, and more.

Stars can then be used to unlock additional platform features, get discounts with select providers, and can even be redeemed for swag items such as t-shirts, mugs, and wallets.

The Pros and Cons of Savology

Despite being hesitant at first take, Savology delivered in many areas. Here’s a quick breakdown of the pros and cons of the platform:

Pros of Savology

- Completely free to use

- Extremely fast (only took me around five minutes to sign up)

- Complimentary report card included

- Several financial literacy components within the app

- No ads or intrusive pop-ups

- Great experience and extremely easy to navigate

- Visual and actionable steps

- Good mix of high-level and specific breakdowns

- Great, reputable service providers recommended (all or vetted and checked)

Cons of Savology

- List of providers is still growing

- Planning modules in beta and not all of them are available

- Plan requires manual updating for the time being

- Not all features are unlocked, requires Savology Stars

Additional Things to Know About Savology

Here are a few additional things to consider about Savology:

1) Savology is completely free to use

There are a ton of personal finance tools and money apps that work on a freemium model, Savology isn’t one of those. Signing up, creating an account and accessing your financial plan is entirely free.

Considering it can cost up to $2,500 to get a financial plan from a traditional or fee-based planner, that is huge.

2) Savology makes money through affiliate relationships

There’s a good chance you’ve been wondering exactly how Savology makes money. Affiliate and partnership models with financial service providers is the answer.

These are the financial providers you have access to in your plan. Partners compensate Savology when users are directed towards their services and take action. This amount varies from provider to provider and depends very much on the type of service.

It’s important to know that even though Savology’s primary revenue stream is through this model, there are several providers on the platform the company is not compensated for. The reason being is to eliminate the bias and provide recommendations that act in the user’s best interest.

Want to Make Extra Money Now?

|