There are so many different money management tools hitting the market each day. Which is a good thing for the average consumer who wants to become more money savvy. Fortunately, there are companies like Personal Capital that can help with the job.

Personal Capital offers a free version that allows you to manage your money all in one place (similar to Mint). It also offers an extensive tool for investors who need advice and want to monitor their investments.

This sophisticated tool can help you track your finances and investments with ease. But before you join, read on to learn more about how the app works, if it’s legitimate and if it’s worth your time using.

What is Personal Capital?

Personal Capital allows you to get access to insight-

The company really is a useful blend of technology and financial resources.

Personal Capital is an excellent example of how good things happen when technology meets finance.

Pros

- Optimal tax planning.

- Tax optimization strategies help keep your taxes low.

- You can opt to get contacted by a financial advisor quickly without limits.

Cons

- The asset management service requires a minimum account size of $100,000 to start

- Not all the features are available on the Personal Capital app.

- Fees are high for the robo-advisory services.

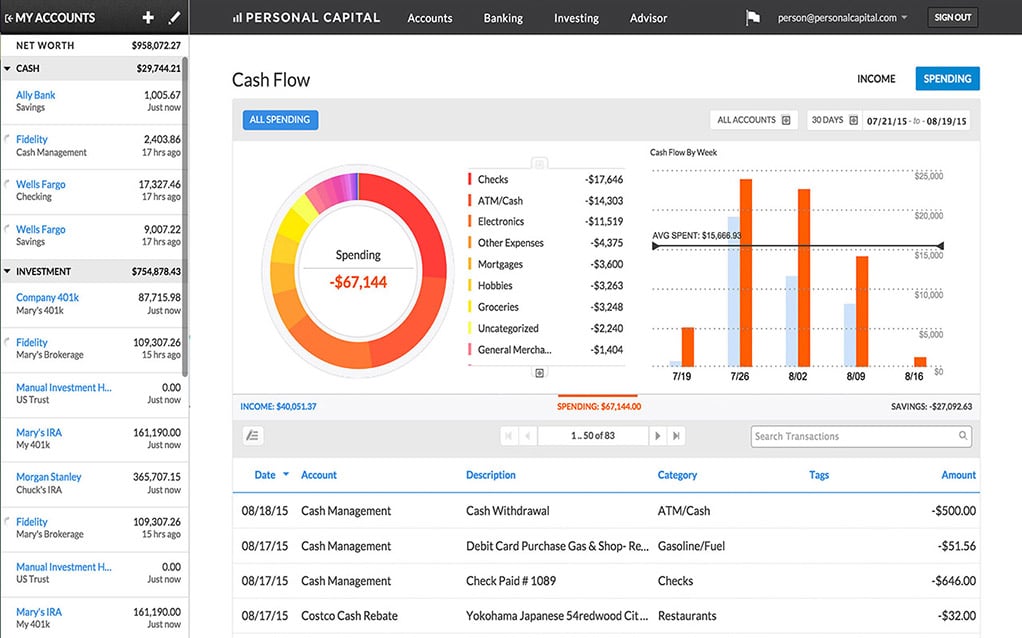

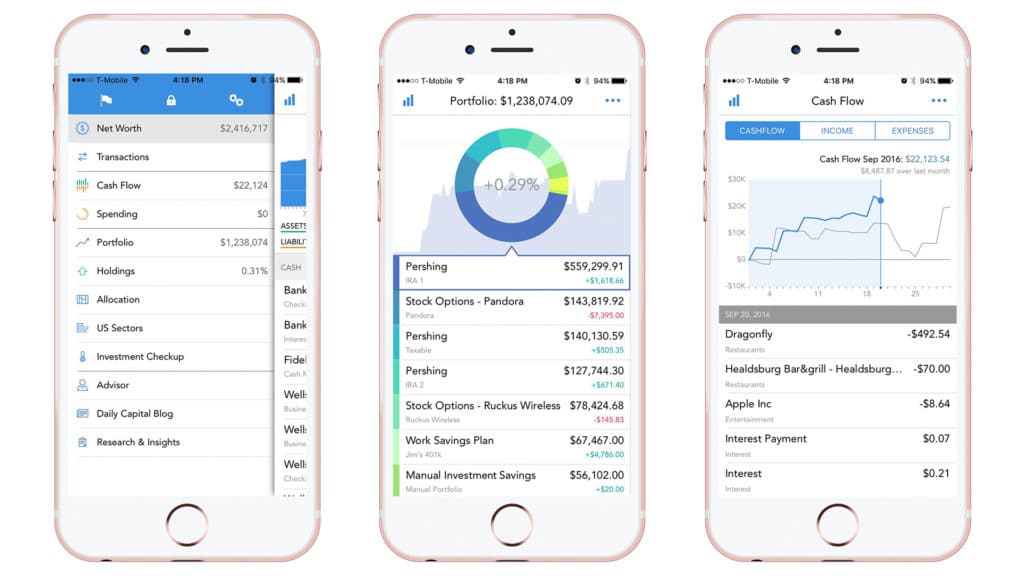

Personal Capital Screenshots

For those of you who want to see it in action, here are some Personal Capital screenshots to see the app in action.

How Does Personal Capital Work?

Personal Capital is more than just a budgeting tool. You can use the platform to manage all of your accounts, including bank accounts, savings accounts, loan accounts, credit cards, and investment portfolios.

It’s easy to get started:

- First, create your free Personal Capital account then you can link your financial accounts.

- All of your transactions and account information are then updated in real time.

- You will know what’s happening at any given time which will help you make the right financial decisions.

Personal Capital App

Personal Capital also has an app that I would recommend using alongside the platform. Anyone can download the Personal Capital app to help manage their personal finances – it’s 100% free.

If you want to track your personal finances on a minute-by-minute basis, using an app is a great place to start. It allows you to manage your spending, monitor investments, and avoid getting into debt.

The Personal Capital app has won tons of awards and scored lots of praise online.

CNN voted it as one of the five best apps to manage investments and iTunes App Store staff voted it as one of their “Top Picks”.

Now let’s look at whether the Personal Capital can make your life easier.

Personal Capital App Features

1. Track Your Spending

One of the best features is how easy it is to track your spending.

It can be difficult to manage several different accounts and credit cards, but once you install the Personal Capital app on your smartphone, you can set a monthly spending target and check whether you are on track.

The app lets you set daily, weekly or monthly spending targets.

If you exceed your spending limit, the app tells you it’s time to quit spending.

Blue means you are good, but red means you should put the shoes down and leave the store immediately.

2. Manage Your Net Worth

If your main objective is to manage your net worth – no problem – Personal Capital is designed to make life easy.

Thanks to the app, you have your entire portfolio on your wrist.

The app monitors your investment portfolio’s performance in real time.

Have you made the right investment decisions? Are your stock holdings on a downward spiral?

Find out by checking the app.

3. Hands-on Management Service

If you prefer, you can pay for a hands-on management service, but this is aimed at high net worth individuals and for the majority of customers, the free app service is sufficient.

Is the Personal Capital App Available on All Platforms?

The best apps work across all platforms and the Personal Capital app is no different. You can download the app from the Apple App Store, Google Play, and it’s also available on Amazon. Use the app on your smartphone, tablet, or smartwatch. The more devices you use, the better able you are to keep track of your financial position.

Is Personal Capital Secure?

Security is a big issue with any online finance management app or platform.

We need to know our data is secure and our accounts protected.

Personal Capital takes cyber security seriously and there are numerous layers of protection in place.

All of your credentials are encrypted and stored in a third-party system.

Each time you register a new device, you must respond to a telephone call or email to verify it’s you.

Personal Capital Summary

Personal Capital is an way to manage your personal finances and it’s 100% free to use.

There are some valuable tools included in the app, such as spending alerts and investment tracking, which are not available in other budgeting apps.

You will find the app easy to use and the interface is very intuitive.

The only negative is that some users have reported annoying glitches, but from a personal perspective, I have had no issues using the app.

Considering all that Personal Capital has to offer, this is a great financial tool that is well worth checking out.

You can set up your free Personal Capital account here.

Do you have any thoughts on the Personal Capital App review? Let us know below!

Want to Make Extra Money Now?

|