Almost all of us would agree that setting aside savings is important for our overall financial health.

However, for most of us, the most difficult thing about saving money is figuring how to get started.

Wouldn’t it be easy to learn how to save money and get paid to do it?

Believe or not, there is. Building your savings is simple with Digit.

This innovative app saves your money without you having to lift a finger. Simply link it to your checking account, and its algorithms will determine small (and safe!) amounts of money to withdraw into a separate, FDIC-insured savings account.

Bottom line: Digit customers have saved over a billion dollars. If you are at all interested in saving money, you should be using the free Digit app.

QUICK FACTS ABOUT DIGIT:

- Saving money used to be hard. Now it’s easy!

- Digit is the effortless way to save money without thinking about it.

- Every day, Digit checks your spending habits and moves money from your checking account to your Digit account, if you can afford it.

- Available for iOS, Play Store, and Twitter.

- Click here to sign up for free.

In this post, you will learn more about an app called Digit which promises a way of making saving a painless and effortless process for its users. It’s time we see how well that works and you can learn if it’s right for you by using our Digit review.

What is Digit?

Digit is essentially an app with a goal of making savings a mindless task for its users. The app is a micro-savings platform that analyzes your spending to determine the perfect amount that you can save over time. Then it makes automatic withdrawals and transfers it to your savings without you even thinking about it.

As Digit’s CEO Ethan Bloch had it, the goal of the app is to make saving as easy, stress-free and automatic as possible.

Simply put, Digit does all the hard work of getting started with your savings. You can go with your regular financial habits and the app figures out how much can be the extra amount and move it into your savings. And, all that is done automatically so you won’t even notice it.

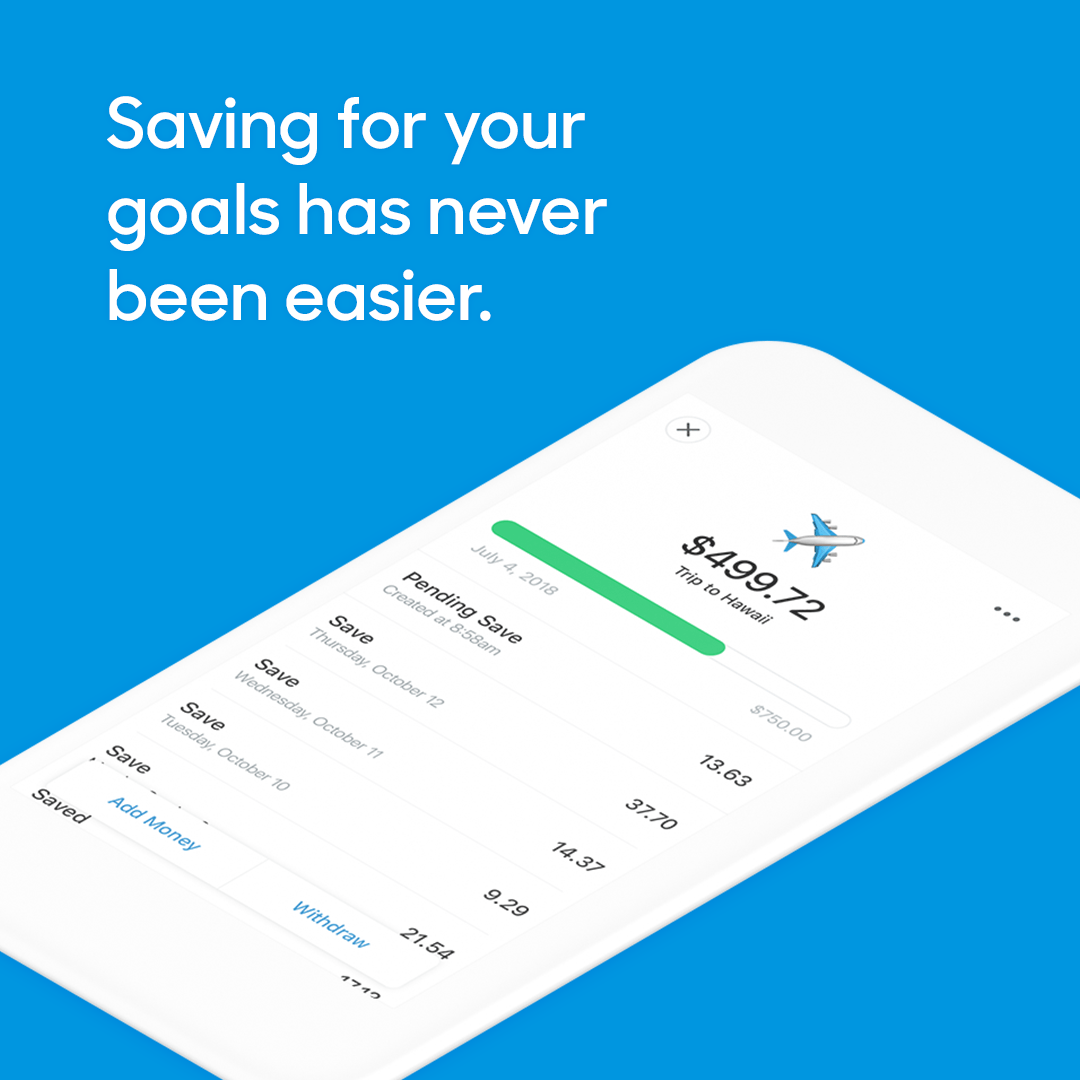

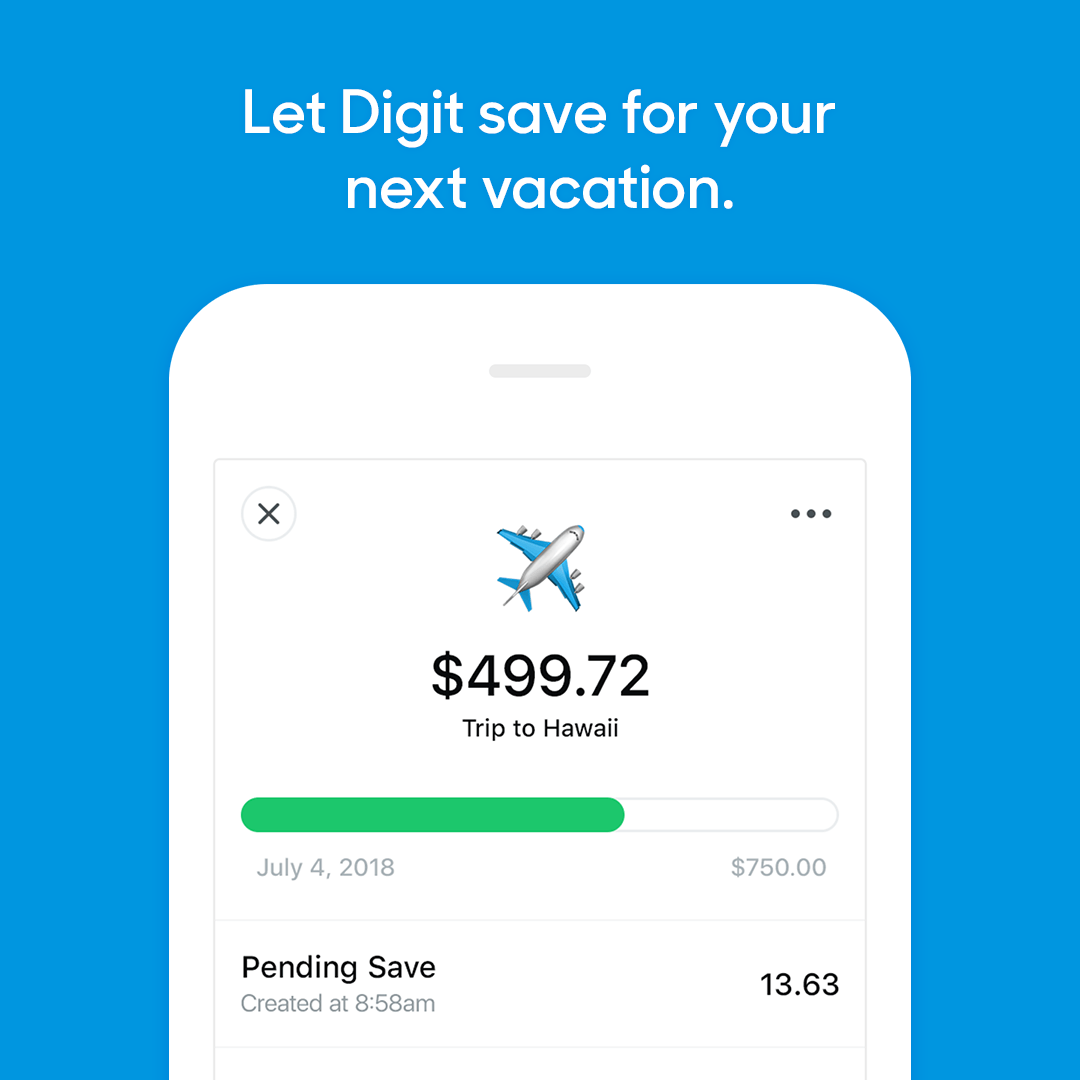

Digit Screenshots

How Does Digit Work?

Ultimately, the goal of Digit is to push non-savers to save money and be more money savvy. All you need to do is sign up for the app and connect your checking account.

The app works by evaluating your financial lifestyle and spending patterns and moves the extra money to your Digit account. The amount of extra money the app automatically transfers will depend on different factors including your checking account balance, your upcoming income, upcoming bills, and your recent spending.

The Digit app is free for the first 30 days. After that, you’ll be charged $5 monthly and you can cancel anytime. It offers 1% annual savings bonus when you save using the app for three consecutive months.

Funds held are FDIC insured, up to $250,000 per depositor. It also enables you to make convenient transactions using your phone SMS services and allows unlimited withdrawals 24/7. When it comes to security, the app utilizes advanced 128-bit encryption to enhance protection of sensitive user information and transactions.

The Good and Bad

What we liked about Digit

|

What we didn’t like about Digit

|

Digit App Testimonials

Digit Alternatives

Digit Promotional Code

| Bonus: SavingJunkie readers can sign up here. Additionally, savers will receive a 1% bonus every three months. |

Is Digit Worth It?

The Digit app can be a great platform to launch your savings habit for short-term savings goals.

The best thing about the app is that it does everything automatically for you.

If you are a non-saver this app can help push you to become one.

Want to Make Extra Money Now?

|