I’d heard about an online service called Blooom that does all the heavy lifting and optimizes your 401(k) for you, in minutes. I decided to dig a little deeper on the service and give you all a quick review that tells you what you need to know: Is Blooom legit? Should I use Blooom?

Quick facts about Blooom:

- Your 401(k) could earn more.

- Take a minute to link up your 401(k) and maximize your investments.

- For $10/ month, Blooom will manage your nest egg so you can enjoy life.

- Click here to sign up and get a free analysis

I’m happy to notice that American’s retirement plans are holding strong in 2021. Last year, the average 401(k) account held $98,000, a 9.6% increase from 2016, according to a Fidelity Investments report.

The report also discovered that employees are stashing away an average of $5,850 a year in their 401(k)s. What does this tell me? Well, you may need more savings than you think, especially if you want to retire early. In fact, a little financial maneuvering right now can make you tens of thousands in the long term. Wouldn’t it make sense to optimize and improve your 401(k) in seconds if it meant you could retire earlier?

If you’re interested, then read on.

Saving Junkie Review on Blooom

LEARN MORE

At Blooom

What is Blooom?

Blooom is an online financial advisor that gives you guidance with your retirement accounts. This is a great option for those who could use a little help in this space. As such, hidden investment fees and improper allocation can eat away at retirement savings — which is where Blooom can help.

Think all financial advisors are created equal? Think again. Blooom is a Registered Investment Advisor (RIA), powered by industry-leading technology. The company stays mindful of its service and fees, but also of your returns. According to Blooom’s website, they believe DIY-ing your retirement is a risk you shouldn’t need to take.

There are financial advisors, then there are Registered Investment Advisors (RIA).

RIAs are held to the highest standard when it comes to financial advice; also known as a fiduciary. The obligation of a fiduciary advisor is to always place the interests of our clients ahead of our own.

Simply put, Blooom believes in loyalty to its clients and their own returns. This standard eliminates the conflict of interest that other types of advisors face, because the product a fiduciary advisor is selling is essentially themselves, their investment philosophy, and their strategy.

Advisors that work for an independent RIA focus solely on the value of the advice and asset management they provide. This is blooom.

Here is a short video about the story of Blooom:

How Does Blooom Work?

To get started, simply link your existing investments to your Blooom platform for free insight into how you’re doing. See something you need help with? Hire Blooom!

Blooom will analyze your 401k for free and in under 5 minutes Blooom can do all of the below:

- Show you how well you are invested

- Pick the best funds available in your 401(k) and IRAs and give you exact percentages of what to invest where

- Show you exact percentages on how many stocks vs. bonds to have

- Show how much you are paying in investment fees and how to potentially pay less (average bloom client cuts their fees in half)

Pro tip: I got in touch with them and they are conveniently offering SavingJunkie readers a free analysis, so act fast (promo code: BM86QVZS).

For any investor who doesn’t know how well their 401(k) is invested or would benefit from professionals analyzing it, it’s pretty powerful. This is especially true if your retirement accounts have over $100,000 in assets. As such, Blooom can help you invest your $100,000 with confidence.

GET YOUR 401K ANALYZED FOR FREE

Blooom in Action

Blooom Features

Blooom has an interesting amount of features whether you are retiring in 15 years or less, more, the features can work for you regardless of your age.

- Finance 101 not required. No more poring over 401(k) investments that read like they are written in a foreign language. You can toss all that in the trash. Blooom will handle all the heavy lifting.

- You owe it to yourself. You and your family are going to depend on your 401(k) someday, right?

- You should be handling your nest egg with care. And if you aren’t doing it, you better find someone to do it for you… that’s where Blooom comes in.

- Better results. Using professional advisory assistance like Blooom has been shown to provide you with a greater potential long-term return.

Blooom has a digital platform for human interaction and advice. They have digitized the traditional advising relationship in order to offer its services to the masses at an affordable price.

So when you need help with a financial decision, are having an issue with your account, or need insight from an advisor, they have real, human advisors and support specialists you can chat with and send feedback to.

Once Blooom’s advisors have seen your plan, it’s technology allows them to manage thousands of people’s accounts much faster than a human ever could.

You’re probably wondering, What’s the catch? There really isn’t one. The analysis is free, (yes, really) because they hope to educate you on the potential improvements that could be made to your retirement strategy—whether they end up earning your business or not.

And if you choose to have Blooom fix and manage your retirement accounts, they charge a flat fee. It’s that simple.

They keep the lights on at Blooom through its annual memberships. Unlike Wall Street, they don’t skim money off your account, or charge in confusing ways like basis points or percentages. What you see is what you get. It’s really the best of both worlds.

You learn a little bit more, feel empowered in your understanding of your own finances, and have its robo advising tools to help along the way.

YOU OWE IT TO YOURSELF, GET STARTED

Related: Wealthsimple Review: Pros, Cons and Is It Legit?

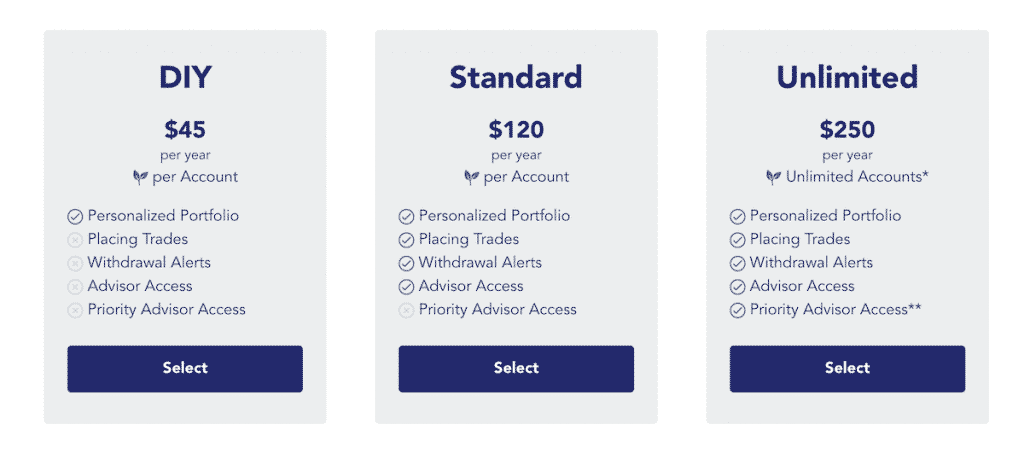

Blooom Pricing

Blooom’s pricing model is simple and very easy to understand.

- DIY: For $45 annually per account, you can buy Blooom’s entry-level package and receive a personalized portfolio.

- Standard: For $120 annually per account, you can upgrade and receive a personalized portfolio, placing trades, withdrawal alerts; and access to a financial planner who will answer questions via email.

- Unlimited: For $250 annually, Blooom will manage unlimited accounts and provide all of the services under the standard plan, as well as allowing you to connect with a financial advisor via live chat.

For comparison, human advisors typically charge around 1% of assets under management, and robo advisors typically range from 0.25% to 0.35%.

Related: How to Trade Stocks for Income

Blooom Promo Code

Blooom is offering SavingJunkie readers a free analysis, which you can claim here.

Is Bloom Worth It?

Yes, absolutely. The second-guessing and worrying about your 401(k) is over. You can rest easy knowing a professional advisor is handling things for your most important investments. You can make thousands of dollars easily over the long term just by getting a free 401(k) analysis here.

More people should be doing this!

GET YOUR 401(K) ANALYZED FOR FREE

(Or click here to learn more about Blooom → )

Want to Make Extra Money Now?

|